|

The new goals experience is now available in beta to all users! Migrate to Goals 3.0 from your Goals page following the instructions here. |

Debt paydown in Monarch helps you track and accelerate your journey toward being debt-free — all from one dashboard. It brings together your loans, credit cards, and other debt accounts into a clear, visual payoff plan, and even allows you to experiment with different pay off scenarios to see how much you can save.

Coming from old Goals? Check out Introducing Goals 3.0 for more information on what’s changed and how to migrate your existing goals!

Table of Contents

- What Are Pay Down Goals?

- Adding and Managing Pay Down Goals

- Budgeting for Pay Down Goals

- Understanding Your Debt Dashboard

- Related Articles

- FAQs

What Are Pay Down Goals?

Each debt account in Monarch is automatically visible in the pay down section of Goals. You don’t need to create a separate “debt goal” — your account is the goal.

For each goal, you’ll see helpful metrics, like total debt principal and projected interest, to help you understand your debt and reach your goals faster.

Adding and Managing Pay Down Goals

Monarch automatically recognizes accounts with outstanding balances as part of debt paydown goals. If your debt account isn’t synced, you can create a manual liability account.

Managing which liability accounts appear

New liability accounts will automatically be included in your Goals pay down view, and you can choose which accounts are included or excluded at any time.

How goals stay in sync with your liability accounts

Your Pay Down goals automatically stay in sync with your liability accounts in Monarch.

- Add a new liability account → It’s automatically added as an active pay down goal

- Delete a liability account → It’s automatically removed from your pay down goals

- Change an account’s type from Liability to Asset → It’s automatically removed from your pay down goals

- Close a liability account (set its balance to $0 but retain its history) → It’s automatically removed from your day down goals

- Hide a liability account → No changes occur in Goals unless you specifically choose to hide or exclude it from the pay down section

How to manually exclude an account:

- From the pay down Goal page, click the three dots to the right of the balance for the account in question.

- Select Exclude account.

How to manually include an account:

- From the pay down Goal page, click Show excluded account.

- Click the three dots to the right of the balance for the account in question.

- Select Include account.

Editing goal details

You can edit pay down goal details to ensure projections are accurate:

- From the pay down Goal page, click the three dots to the right of the balance for any account.

- Select Edit account details.

- Add or update:

-

Interest rate (APR)

- Note: This can be set to 0%.

-

Minimum monthly payment

- Note: When setting minimum monthly payment, only include principal and interest—do NOT include tax or insurance costs.

-

Planned monthly payment (optional)

-

Note: The planned monthly payment only needs to be set when you plan to pay a different amount than minimum monthly payment.

-

-

Interest rate (APR)

- Recommended: Toggle Exclude account from debt paydown if you pay off the account monthly (like a credit card you don’t carry a balance on).

Tip: These fields are what power your debt-free date and total interest projection.

Budgeting for Pay Down Goals

Debt paydown works separately from Goals in your budget. Your pay down dashboard tracks progress using your real account balances, so there’s no need to link transactions or worry about double-counting payments. It’s important to know how those payments appear in your budget.

How debt payments affect your budget

When you make a payment toward a loan, credit card, or other debt account, the category of that transaction determines whether it appears in your budget.

- If the payment is categorized as an Expense (for example, “Debt Payment” or “Auto Loan Payment”), it will show up in your budget.

- If it’s categorized as a Transfer, it won’t, because transfers move money between accounts but don’t count toward your spending plan.

This is consistent with how Monarch treats transfers and credit card payments: only expense categories impact your budget totals, while transfers affect your account balances but not your spending plan.

Note on credit card debt:

Using an expense category for debt payments is the recommended way to budget for pay down goals today. However, for credit cards, this can sometimes result in double counting if the original card purchases were already recorded as expenses in your budget.

We recognize this isn’t ideal and is a known limitation of the current setup. We’re actively exploring better ways to handle budgeting for credit card debt in the future.

Understanding Your Debt Dashboard

The main pay down page gives you an overview of your entire debt landscape.

You’ll see:

- Summary cards at the top showing:

- Your Current Debt Principal across all accounts

- Projected Interest owed across all accounts

- Total Principal & Interest combined for all accounts

- Estimated Debt-Free Date

- A color-coded projection chart

- A list of liability accounts grouped by type

Reading the projection chart

The projection chart shows a curved line for each account, showing when the payoff is expected to occur based on your current settings. You can view it by Timeline or by Principal & Interest.

Tip: If you change your planned payments, the chart and debt-free date will update automatically.

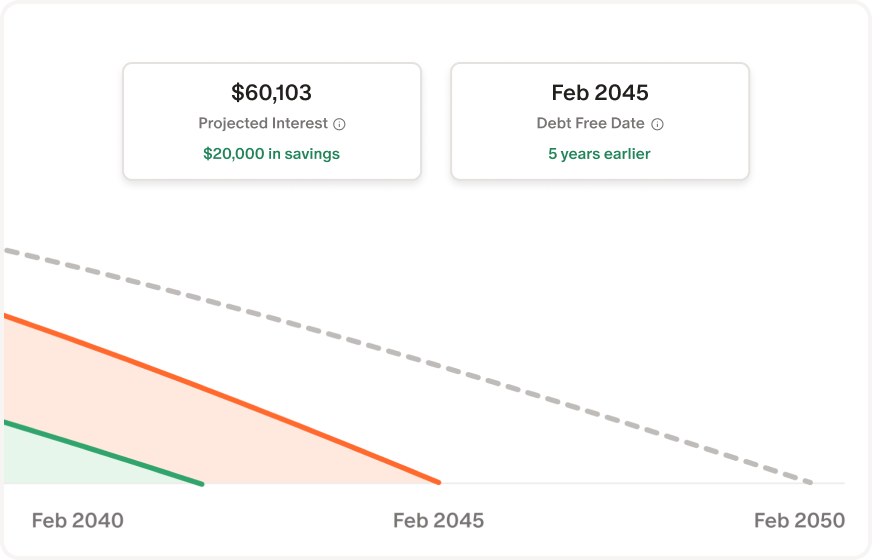

Using the savings calculator

Use the savings calculator to simulate different payoff scenarios, without changing your actual payments or budget. The built-in calculator lets you see how extra payments affect your timeline and total interest. Play around — it’s a safe place to dream about getting debt-free faster!

To run a simulation:

- Select Pay down from the Goals page.

- From the Savings calculator on the right side, choose a monthly extra payment, a one-time extra payment, or both.

- Pick your payoff method:

- Avalanche: Pay highest-interest debts first (saves more in total interest)

- Snowball: Pay smallest balances first (builds momentum faster)

-

Planned payments: Pay only the scheduled minimum or planned payments

Note: When using the avalanche or snowball methods, Monarch rolls over the full payment amount from paid-off debts — including minimum or planned payments — into your remaining balances, rather than only applying additional “extra” payments.

-

The chart will automatically update as you change numbers and payoff methods. You’ll see:

- A banner at the very top showing the applied method (e.g. “Avalanche with $100 monthly extra”).

- Updated summary cards at the top showing the new projected numbers.

- A dotted line showing the old payoff timeline.

- Colored lines showing the new projected payoff timelines.

Remember, this is just a simulation and will not update your actual budgeted amount.

Tip: You can clear your simulation anytime to return to your current payment plan.

Related Articles

FAQs

- Why is Goals in public beta, and what does that mean? Why not make it part of Labs?

- What’s the difference between avalanche and snowball in the savings calculator?

- Can I include mortgages and auto loans?

- Why can’t I connect more than one debt account to a single goal?

- Where did my debt pay down goals go in the budget?

- How do I change my debt-free date?

- Can I still see how much I’ve contributed to paying down debt over time?

- Can I link my crypto account in Goals?

Why is Goals in public beta, and what does that mean? Why not make it part of Labs?

Goals 3.0 is in public beta because it’s ready for real use, but still evolving.

You’ll find that this version of Goals is already rich with new functionality, smarter tracking, and design improvements. But there’s more to come, and public beta lets us gather your feedback as we finish building out the full experience.

Unlike Labs features, which are more experimental, public beta means this version of Goals is stable and supported — just not yet final.

If you’d rather wait for the complete rollout, that’s perfectly fine too. The full experience will be available early next year, once all planned features are released.

What’s the difference between avalanche and snowball in the savings calculator?

- Avalanche: Prioritizes high-interest debts, saving you more on interest overall.

- Snowball: Prioritizes smaller balances, giving you quicker wins and motivation early on.

Can I include mortgages and auto loans?

Yes. Any liability account can appear as a pay down goal. To see principal and interest projections in the chart, make sure you’ve entered the account’s interest rate and at least one monthly payment amount.

Why can’t I connect more than one debt account to a single goal?

Each debt account is now tracked individually. This ensures more accurate forecasts since each may have different interest rates, balances, and minimum payments, and helps you see which debts to focus on first.

Where did my debt pay down goals go in the budget?

Debt payments now appear as expenses in your budget, rather than as goals. This change clarifies your monthly plan and prevents double-counting payments.

You can still track your payoff progress in the pay down Goals section, and use an expense category to plan for those payments in your budget.

How do I change my debt-free date?

Update your planned monthly or one-time payments in the savings calculator to instantly see how your payoff timeline changes.

Can I still see how much I’ve contributed to paying down debt over time?

The pay down view focuses on your overall progress and payoff timeline instead of contribution charts.

If you want to see your history of payments, check the balance chart on the account page — it shows how your debt has decreased over time.

Can I link my crypto account in Goals?

Not yet! We plan to explore crypto support in the future.

Why does the debt timeline show I'll pay off debt sooner than expected?

If your projected payoff date looks too optimistic, first double-check the payment details you’ve entered for the account.

When setting a minimum or planned monthly payment, only include the portion that goes toward principal and interest. Do not include taxes, insurance, or escrow amounts, as those aren’t applied to reducing your loan balance and can make the projection appear shorter than it should be.

I have a credit card that I pay off every month. Can I exclude it in my debt projection?

This is a common scenario. If you don’t carry a balance and pay the card off each month, we recommend excluding that account from your pay down goals.

To exclude an account:

On web, click the three dots next to the account in the Pay Down view and select Exclude account.

On mobile, long-press the account card and select Exclude account.

Excluding the account removes it from your payoff projections and debt-free date calculations, while still keeping the account connected elsewhere in Monarch.